The IPOX® Week #731

Earnings trump Inflation: IPOX® 100 U.S. (ETF: FPX) tops weekly rankings.

Big strength extends to markets outside the U.S. IPOX® MENA lags.

IPOX®’s Indonesian exposure surges to post-IPO Highs.

Another solid week for European and U.S. deals. Track IPO filings here.

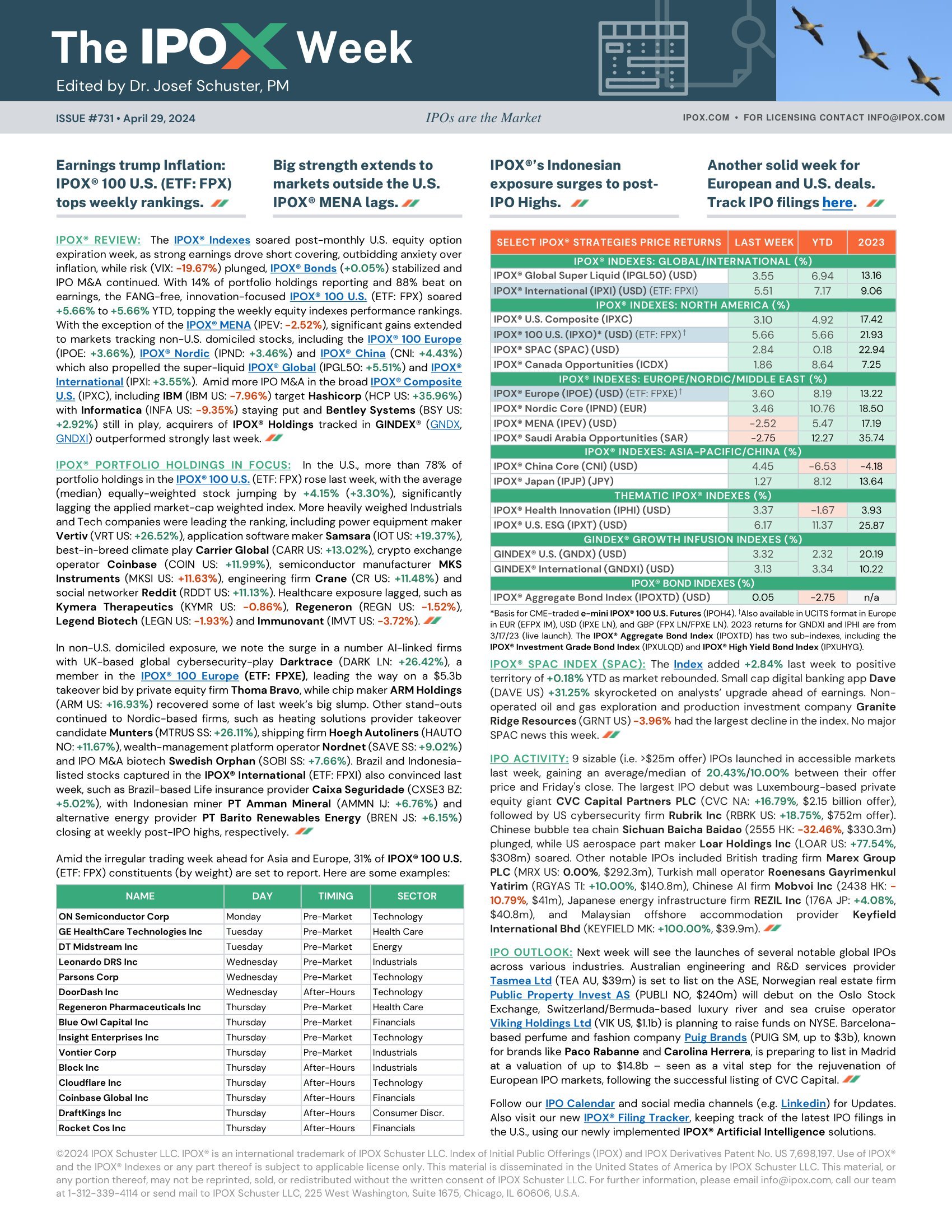

IPOX® REVIEW: The IPOX® Indexes soared post-monthly U.S. equity option expiration week, as strong earnings drove short covering, outbidding anxiety over inflation, while risk (VIX: -19.67%) plunged, IPOX® Bonds (+0.05%) stabilized and IPO M&A continued. With 14% of portfolio holdings reporting and 88% beat on earnings, the FANG-free, innovation-focused IPOX® 100 U.S. (ETF: FPX) soared +5.66% to +5.66% YTD, topping the weekly equity indexes performance rankings. With the exception of the IPOX® MENA (IPEV: -2.52%), significant gains extended to markets tracking non-U.S. domiciled stocks, including the IPOX® 100 Europe (IPOE: +3.66%), IPOX® Nordic (IPND: +3.46%) and IPOX® China (CNI: +4.43%) which also propelled the super-liquid IPOX® Global (IPGL50: +5.51%) and IPOX® International (IPXI: +3.55%). Amid more IPO M&A in the broad IPOX® Composite U.S. (IPXC), including IBM (IBM US: -7.96%) target Hashicorp (HCP US: +35.96%) with Informatica (INFA US: -9.35%) staying put and Bentley Systems (BSY US: +2.92%) still in play, acquirers of IPOX® Holdings tracked in GINDEX® (GNDX, GNDXI) outperformed strongly last week.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: In the U.S., more than 78% of portfolio holdings in the IPOX® 100 U.S. (ETF: FPX) rose last week, with the average (median) equally-weighted stock jumping by +4.15% (+3.30%), significantly lagging the applied market-cap weighted index. More heavily weighed Industrials and Tech companies were leading the ranking, including power equipment maker Vertiv (VRT US: +26.52%), application software maker Samsara (IOT US: +19.37%), best-in-breed climate play Carrier Global (CARR US: +13.02%), crypto exchange operator Coinbase (COIN US: +11.99%), semiconductor manufacturer MKS Instruments (MKSI US: +11.63%), engineering firm Crane (CR US: +11.48%) and social networker Reddit (RDDT US: +11.13%). Healthcare exposure lagged, such as Kymera Therapeutics (KYMR US: -0.86%), Regeneron (REGN US: -1.52%), Legend Biotech (LEGN US: -1.93%) and Immunovant (IMVT US: -3.72%).

In non-U.S. domiciled exposure, we note the surge in a number AI-linked firms with UK-based global cybersecurity-play Darktrace (DARK LN: +26.42%), a member in the IPOX® 100 Europe (ETF: FPXE), leading the way on a $5.3b takeover bid by private equity firm Thoma Bravo, while chip maker ARM Holdings (ARM US: +16.93%) recovered some of last week’s big slump. Other stand-outs continued to Nordic-based firms, such as heating solutions provider takeover candidate Munters (MTRUS SS: +26.11%), shipping firm Hoegh Autoliners (HAUTO NO: +11.67%), wealth-management platform operator Nordnet (SAVE SS: +9.02%) and IPO M&A biotech Swedish Orphan (SOBI SS: +7.66%). Brazil and Indonesia-listed stocks captured in the IPOX® International (ETF: FPXI) also convinced last week, such as Brazil-based Life insurance provider Caixa Seguridade (CXSE3 BZ: +5.02%), with Indonesian miner PT Amman Mineral (AMMN IJ: +6.76%) and alternative energy provider PT Barito Renewables Energy (BREN JS: +6.15%) closing at weekly post-IPO highs, respectively.

Amid the irregular trading week ahead for Asia and Europe, 31% of IPOX® 100 U.S. (ETF: FPX) constituents (by weight) are set to report. Here are some examples:

IPOX® SPAC Index (SPAC): The Index added +2.84% last week to positive territory of +0.18% YTD as market rebounded. Small cap digital banking app Dave (DAVE US) +31.25% skyrocketed on analysts’ upgrade ahead of earnings. Non-operated oil and gas exploration and production investment company Granite Ridge Resources (GRNT US) -3.96% had the largest decline in the index. No major SPAC news this week.

IPO ACTIVITY: 9 sizable (i.e. >$25m offer) IPOs launched in accessible markets last week, gaining an average/median of 20.43%/10.00% between their offer price and Friday's close. The largest IPO debut was Luxembourg-based private equity giant CVC Capital Partners PLC (CVC NA: +16.79%, $2.15 billion offer), followed by US cybersecurity firm Rubrik Inc (RBRK US: +18.75%, $752m offer). Chinese bubble tea chain Sichuan Baicha Baidao (2555 HK: -32.46%, $330.3m) plunged, while US aerospace part maker Loar Holdings Inc (LOAR US: +77.54%, $308m) soared. Other notable IPOs included British trading firm Marex Group PLC (MRX US: 0.00%, $292.3m), Turkish mall operator Roenesans Gayrimenkul Yatirim (RGYAS TI: +10.00%, $140.8m), Chinese AI firm Mobvoi Inc (2438 HK: -10.79%, $41m), Japanese energy infrastructure firm REZIL Inc (176A JP: +4.08%, $40.8m), and Malaysian offshore accommodation provider Keyfield International Bhd (KEYFIELD MK: +100.00%, $39.9m).

IPO OUTLOOK: Next week will see the launches of several notable global IPOs across various industries. Australian engineering and R&D services provider Tasmea Ltd (TEA AU, $39m) is set to list on the ASE, Norwegian real estate firm Public Property Invest AS (PUBLI NO, $240m) will debut on the Oslo Stock Exchange, Switzerland/Bermuda-based luxury river and sea cruise operator Viking Holdings Ltd (VIK US, $1.1b) is planning to raise funds on NYSE. Barcelona-based perfume and fashion company Puig Brands (PUIG SM, up to $3b), known for brands like Paco Rabanne and Carolina Herrera, is preparing to list in Madrid at a valuation of up to $14.8b – seen as a vital step for the rejuvenation of European IPO markets, following the successful listing of CVC Capital.

Follow our IPO Calendar and social media channels (e.g. Linkedin) for Updates. Also visit our new IPOX® Filing Tracker, keeping track of the latest IPO filings in the U.S., using our newly implemented IPOX® Artificial Intelligence solutions.