The IPOX® Week #727 - Q1 2024 Review

IPOs are back and perform strongly. Stellar Earnings trump inflation anxiety.

IPOX® 100 U.S.: +10.57% IPOX® 100 Europe: +12.74% IPOX® Internat’l: +9.55%

Global IPO activity jumps. U.S. leads global IPO race, followed by Europe.

Long list of firms lined up as filings/pre-IPO activity increases.

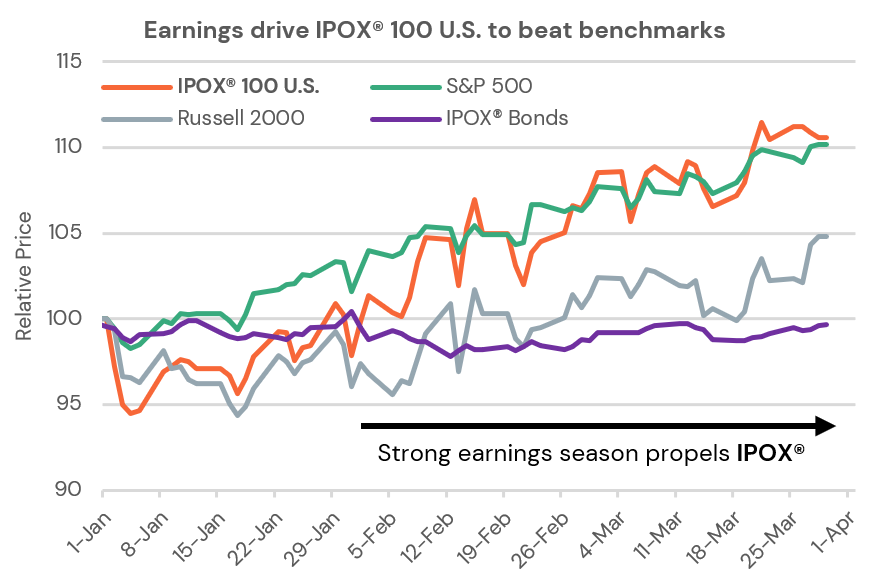

IPOX® Q1 PERFORMANCE REVIEW: Most IPOX® Indexes recorded stellar returns during Q1 2024 and outperformed their benchmarks as strong earnings trumped the overhang from high interest rates, while risk (VIX: +4.50%) traded relatively flat. Amid stable yields for IPOX® Corporate Bonds (IPOXTD: -0.32%), performance during the quarter, however, was uneven: In January, renewed anxiety over persistent inflation derailed Central Banks' rate cut plans, while relentless short selling in select names drove further relative weakness. However, as companies began reporting Q4 2023 earnings and providing corporate outlooks, portfolio performance significantly improved, with IPOX® Indexes eventually benefiting over-proportionately from increased risk appetite and a broadening rally in equities. In the U.S., e.g., the IPOX® 100 U.S. (IPXO) - underlying for multiple Financial products including ETFs (ticker: FPX) and Futures (front month: IPOM4) - rose +10.57% during Q1/24, its 17th best quarter since its live launch on August 13, 2004. While the IPOX® ESG Index (IPXT: +17.26%) remained supercharged and the IPOX® SPAC (SPAC: +3.09%) also recorded gains, strong performance extended to markets abroad tracking non-U.S. domiciled exposure.

The IPOX® 100 Europe (IPOE), e.g., surged +12.74%, while other regions also recorded significant gains. The IPOX® Canada (ICDX) rose by +8.90%, the IPOX® MENA (IPEV) increased by +8.55%, and the IPOX® Japan (IPJP) jumped +14.54%, with all regional indexes outperforming their respective benchmarks and factor-adjusted returns.

The strength in the IPOX® Regional Indexes also contributed to the robust performance of the IPOX® Global (IPGL50) and IPOX® International (IPXI), which gained +12.59% and +9.55%, respectively.

IPOX® Q1 TOPS and FLOPS: Among IPOX® holdings tracked in respective Financial Products (ETFs: FPX, FPXI, and FPXE) with a market cap exceeding $5 billion, we note significant returns for companies in GICS sectors beyond Technology. Leading the pack was German defense contractor and 2020 IPO Hensoldt AG (HGY US: +78.03%), an IPOX® 100 Europe (ETF: FPXE) member, benefiting from numerous upgrades following robust 2024 order growth driven by government spending. Amid the ongoing enthusiasm for A.I., British Softbank-backed chip designer ARM Holdings (ARM US) soared +66.33%, while Industrial Vertiv (VRT US: +70.10%) continued to trade as one of the most impressive de-SPACs. We also observed gains in U.S.-traded alternative energy giant Constellation Energy (CEG US: +58.45%), which now surpassed the market cap of its spin-off parent, IL-based utility Exelon (EXC US: +4.65%). Select specialty companies in the Financial Sector also recorded notable gains, including CA-based online trading app Robinhood (HOOD US: +58.01%), crypto exchange operator Coinbase (COIN US: +52.44%), Brazil-based online bank Nu Holdings (NU US: +43.22%), and Saudi exchange operator Saudi Tadawul Group (TADAWUL AB: +46.04%), which benefited from consistently robust ECM activity in the region. Additionally, strong earnings propelled German truck maker Daimler Trucks (DTG GY) to a +38.03% gain.

IPO M&A Activity Surges in Q1 2024: The first quarter of 2024 witnessed a flurry of high-profile IPO M&A activity driving the performance of select IPOX® Indexes. TUMI luggage maker Samsonite (1910 HK), a member of the IPOX® International Index, attracted attention from global buyout firms such as Carlyle Group, KKR, Bain Capital, and CVC Capital Partners. Pharma giant Bristol Myers Squibb completed its $14 billion acquisition of Karuna Therapeutics (KRTX US), a component of the IPOX® 100 U.S. and IPOX® Health Innovation Indexes. In Europe two members of the IPOX® 100 Europe Index have become acquisition targets: Warner Music Group announced its intention to bid for French digital music company Believe (BLV FP), potentially outbidding an earlier offer from a consortium led by Believe's CEO, while German biotech firm Morphosys (MOR GR) entered into an agreement to be acquired by Swiss pharma giant Novartis for €2.7 billion. Johnson & Johnson reportedly engaged in talks to acquire Shockwave Medical (SWAV US), an innovative medical device company within the IPOX® Health Innovation Index. This wave of M&A activity involving newly listed companies across various IPOX® Indexes highlights the continued appetite for growth and consolidation, as larger corporations seek to expand their portfolios and gain access to innovative technologies and intellectual property – a strategy we track with our unique GINDEX® Growth Infusion Indexes.

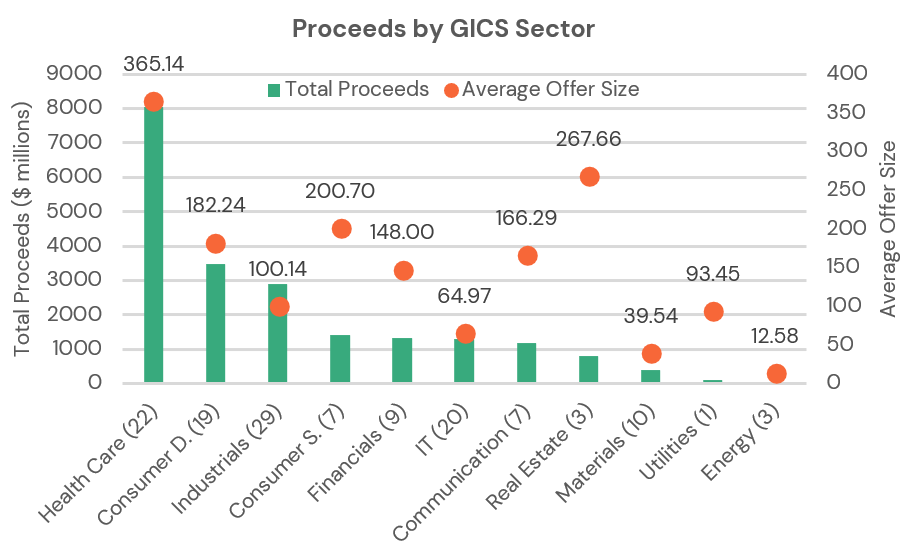

GLOBAL IPO PROCEEDS: In Q1 2024, we observed a total of 130 global IPOs raising $20.93 billion, compared to 153 listings raising $17.56 billion in Q4 2023, an increase in IPO volume of +19.21%. Exchanges in the United States once again manifested themselves as the most attractive markets, seeing a significant increase in the number of new listings, from 24 to 35 (+45.83%), raising a total of $7.4 billion compared to $3.0 billion last quarter, a surge of +150% in total proceeds. The average/median IPO in the U.S. raised $211 million (+71.31%) and $13.8 million (+21.59%), respectively.

Amid a slower start to the IPO year abroad, several large markets outside the U.S. saw declines in the proceeds raised last quarter compared to Q4 2023, with India ($1.45b, -46.74%), Hong Kong ($746m, -71.93%), Saudi Arabia ($714m, -62.92%), Japan ($501m, -53.37%), Turkey ($384m, -40.81%) and South Korea ($327m, -76.36%) still warming up their IPO pipeline.

IPOS BY SIZE AND GICS SECTOR: Among the largest offerings of the last quarter, Swiss dermatology company Galderma (GALD SW) topped the list, raising $4.76 billion in its IPO. The largest U.S. IPO was Finnish sporting goods company Amer Sports, known for brands such as Arcteryx and Wilson, which raised $1.37 billion. Germany-based beauty retailer Douglas (DOU GR) and U.S.-based social media platform Reddit (RDDT US) also made significant debuts, raising $966 million and $860 million, respectively. However, the best-performing IPO among the largest top 10 was German tank gearbox maker IPOX® 100 Europe member RENK (R3NK GR), benefiting from demand for defense stocks. Other notable performers included U.S.-based semiconductor company Astera Labs (ALAB US), which has more than doubled in value since its $809 million IPO, and Mexico-domiciled U.S.-listed specialty foods distributor BBB Foods Inc (TBBB US), which raised $668 million. Considering last quarter’s debuts by GICS Sector, Health Care sector stood out, having raised the most money with about $8 billion and the largest average offer, at $365 million per IPO, as the sector included Swiss heavyweight Galderma, BrightSpring Health Services ($693m) and CG Oncology ($437m).

Between IPO offer price and Q1 close, equally-weighted Global IPOs rose +38.21% (average) / +11.91% (median), with outsized gains in select micro-cap listings, e.g. Hong Kong-listed Advertising firm Lesi Group (2540 HK: +526.36%. $17.6m offer), South Korean nuclear power maintenance service provider Woojin Ntec (457550 KS: +388.68%, $8.2m offer) and Chinese vehicle monitoring firm Changjiu Holdings (6959 HK: +356.30%, $38.4m offer). In developed markets, we also noted outsized median returns from final offer price to first close in the 41 firms that priced above range midpoint (+53.00%) compared to those 29 debuts that priced below midpoint (-2.00%).

NEW LISTINGS OUTLOOK: Looking ahead to the upcoming quarters, several notable companies are lined up to go public across various sectors. In the technology space, cloud data security startup Rubrik is expected to raise between $500-700 million in its April 2024 U.S. IPO, while cloud-based network security provider Cato Networks and Illinois-based healthcare A.I. startup Tempus Labs, led by Groupon co-founder Eric Lefkofsky, are also planning U.S. IPOs. In the consumer sector, cashback and rewards app Ibotta is set to raise $100 million in the U.S., while entertainment and media giant Lionsgate Studios is preparing for a U.S. listing via a SPAC deal at $4.6 billion valuation. In Europe, Milan is set to host Italian gas supplier 2i Rete Gas ($650 million) and luxury sneaker maker Golden Goose. Finally, South Korean biosimilar giant Celltrion Holdings is gearing up for a massive $3.7 billion IPO on the Nasdaq in late 2024 or early 2025. We also note strong spin-off activity, with wind energy unit GE Vernova (GEV US) and 3M unit Solventum (SOLV US) kicking off a strong Europe and U.S. spin-off cycle, involving U.S. telecom Liberty Global, Retail REIT Site Centers, memory chipmaker Western Digital and energy firm TC Energy, for example.

Follow our IPO Calendar and social media channels (e.g. Linkedin) for Updates.