The IPOX® Watch: Caixa Seguridade Participações S.A.

COMPANY DESCRIPTION

Caixa Seguridade Participações S.A. is a leading Brazilian financial services company that consolidates the insurance, premium bonds, private pension plans, credit letters, brokerage, and related segments from state-owned financial institution Caixa Econômica Federal (CAIXA). With a history dating back to 1967, when CAIXA began operating in the insurance market, Caixa Seguridade was incorporated on May 21, 2015, as a wholly-owned subsidiary of CAIXA.

BUSINESS MODEL

Caixa Seguridade generates revenue by offering a wide range of life and non-life insurance policies, private pension plans, premium bonds, and credit letters through its extensive distribution network. For this, the company signed new association agreements with various partners in 2021, including CNP Assurances (Credit Letters), Tokio Marine (Home Mortgages), Icatu (Premium Bonds), and Tempo Assist (Assistance Service), to expand offerings in different segments.

The company leverages CAIXA's vast reach, which includes more than 4,000 branches as the largest bank in terms of deposits and loans. Caixa Seguridade is the fastest-growing bancassurance operation in Brazil and the third-largest insurer in the country. It has significantly increased its share in the insurance market in recent years and is the leader in the mortgage insurance segment, with a market share of more than 60%. The company also participates from insurance products sold in Brazilian mid-sized commercial bank Banco PAN's distribution network through its subsidiaries, Too Seguros (Insurance) and PAN Corretora (Brokerage), of which Caixa Seguidade owns 49%.

IPO HISTORY

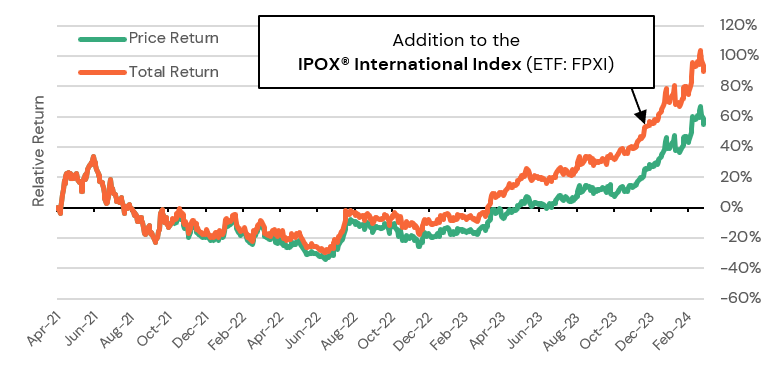

On 04/29/2021, Caixa Seguridade completed its IPO on the Novo Mercado segment of the B3 stock exchange (CXSE3 BZ), raising BRL 5.0 billion (approximately USD 877.74 million) in an offer led by Banco Itaú BBA, BofA Securities, Caixa Econômica Federal, Credit Suisse, Morgan Stanley, and UBS BB Investment Bank. The company priced its IPO at BRL 9.67 per share, with the offering consisting of 450 million base offer shares and a supplementary lot of 67.5 million shares. Following the IPO, Caixa Seguridade had 17.25% of its shares in free float. CAIXA remains the controlling shareholder of the company.

Caixa Seguridade Participações S.A. was included in the IPOX® International Index (ETF: FPXI US) on 12/18/2023 and currently weighs approximately 1.53% of the portfolio. As of its closing price on 3/26/2024, the stock has gained +28.55% since being added to our index.