The IPOX® Watch: Amman (AMMN IJ)

COMPANY DESCRIPTION

Amman Mineral Internasional Tbk PT, commonly known as Amman, is an Indonesian mining company with a focus on gold and copper extraction. The company, which is among the 10 largest mining firms worldwide by market capitalization ($31.1 billion), was founded in 1986 and it is headquartered in Jakarta, Indonesia. Amman's business is the sourcing and sale of raw metals, mined from the company's flagship operation in the Batu Hijau open pit mine on the island Sumbawa, the second largest copper-gold mine in Indonesia. In FY 2022, the mine has yielded 464 million pounds of copper (worth around $28 billion), 730,700 ounces of gold (~$1.5 billion) and 2.2 million ounces of silver (~$51 million). Copper, the mine's primary product, is a crucial element of electrical cables and digital device components. Fueled by high demand in the transition to green energy, its price has increased by +250% in the last 20 years. Apart from its core mining unit, the firm's business operations include a unit focusing on HR, the construction of downstream processing and refining, as well as a real estate developing unit, which also offers financial and insurance services.

INDONESIAN IPO MARKET IN 2023

Indonesia has emerged as one of the world's strongest IPO markets in 2023, driven by green energy demand and natural resources. New listings in the country raised approximately $3.2B, a substantial increase compared to $1.4B raised in 2022. Most money was raised in the materials industry (about $2B), particularly those that supply battery materials, aligning with the country's push to develop its green energy sector. The Indonesian government's focus is to reduce reliance on fossil fuels and leveraging its abundant natural resources, especially nickel, which is crucial for electric vehicle (EV) battery production.

INDONESIAN GREEN ENERGY SECTOR LISTINGS

Amman ($715m offer) was the largest Indonesian IPO in 2023, followed by nickel miner Trimegah Bangun Persada (NCKL IJ, $645m) and nickel/cobalt producer Merdeka Battery Materials (MBMA IJ, $610m). This was followed by renewable energy firms, such as state-owned Pertamina Geothermal Energy (PGEO IJ, $604m) and Barito Renewables Energy (BREN IJ, $203m), which aim to generate electricity from geothermal hot springs, benefiting from Indonesia's high volcanic activity due to its location on the Pacific "Ring of Fire". For 2024, the first sizable Indonesian IPO of the year was another nickel miner, Adhi Kartiko Pratama (NICE IJ, $34m), which launched on January 8 and surged +19.86% on its first trading day. While the country's IPO market has slightly slowed down ahead of the February elections, several state-backed firms could come to market this year, including palm oil producer PalmCo, fertilizer maker Pupuk and natural gas firm Pertamina Hulu Energi.

IPO DETAILS

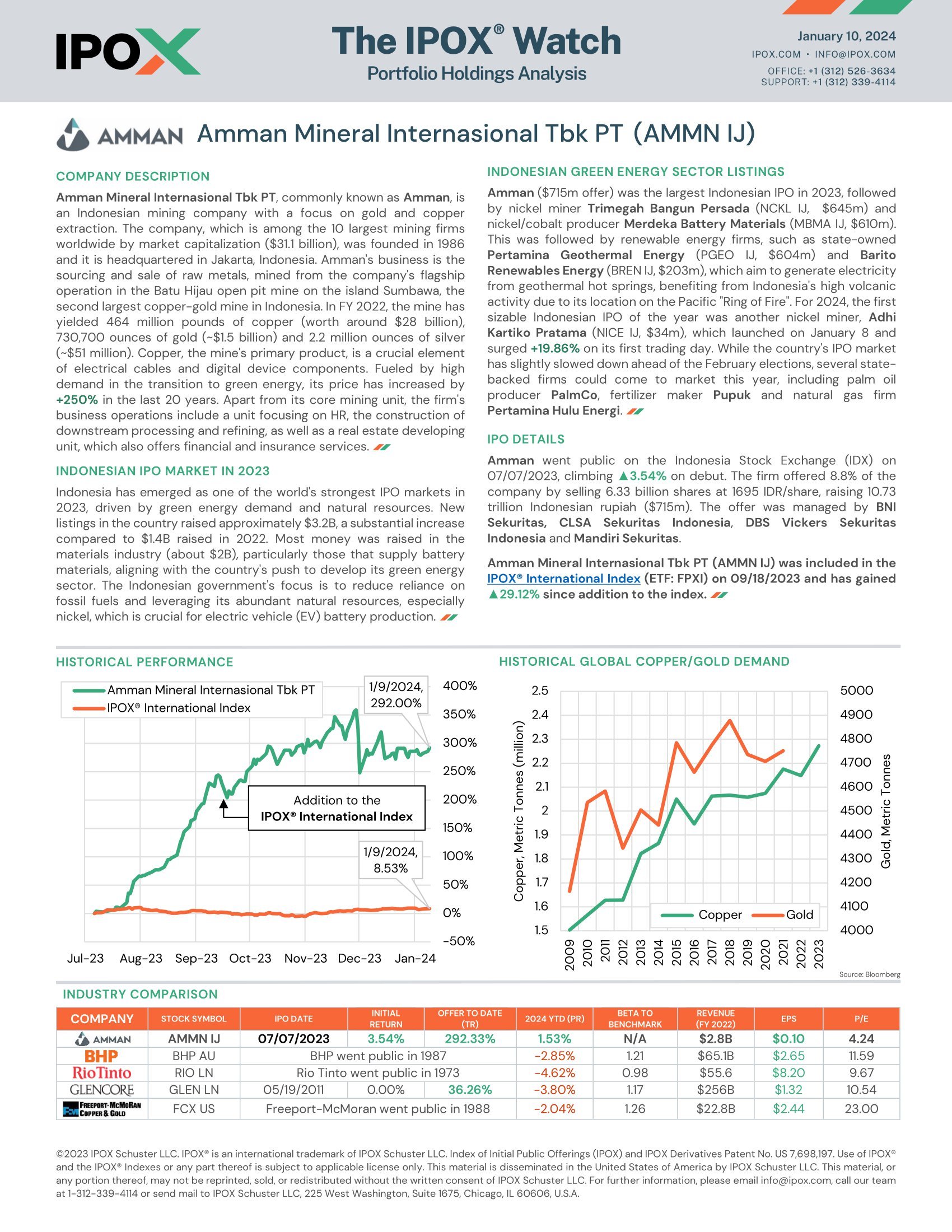

Amman went public on the Indonesia Stock Exchange (IDX) on 07/07/2023, climbing +3.54% on debut. The firm offered 8.8% of the company by selling 6.33 billion shares at 1695 IDR/share, raising 10.73 trillion Indonesian rupiah ($715m). The offer was managed by BNI Sekuritas, CLSA Sekuritas Indonesia, DBS Vickers Sekuritas Indonesia and Mandiri Sekuritas.

Amman Mineral Internasional Tbk PT (AMMN IJ) was included in the IPOX® International Index (ETF: FPXI) on 09/18/2023 and has gained +29.12% since addition to the index.