The IPOX® SPAC Research – U.S. SPAC Market Review and Outlook, FY 2021

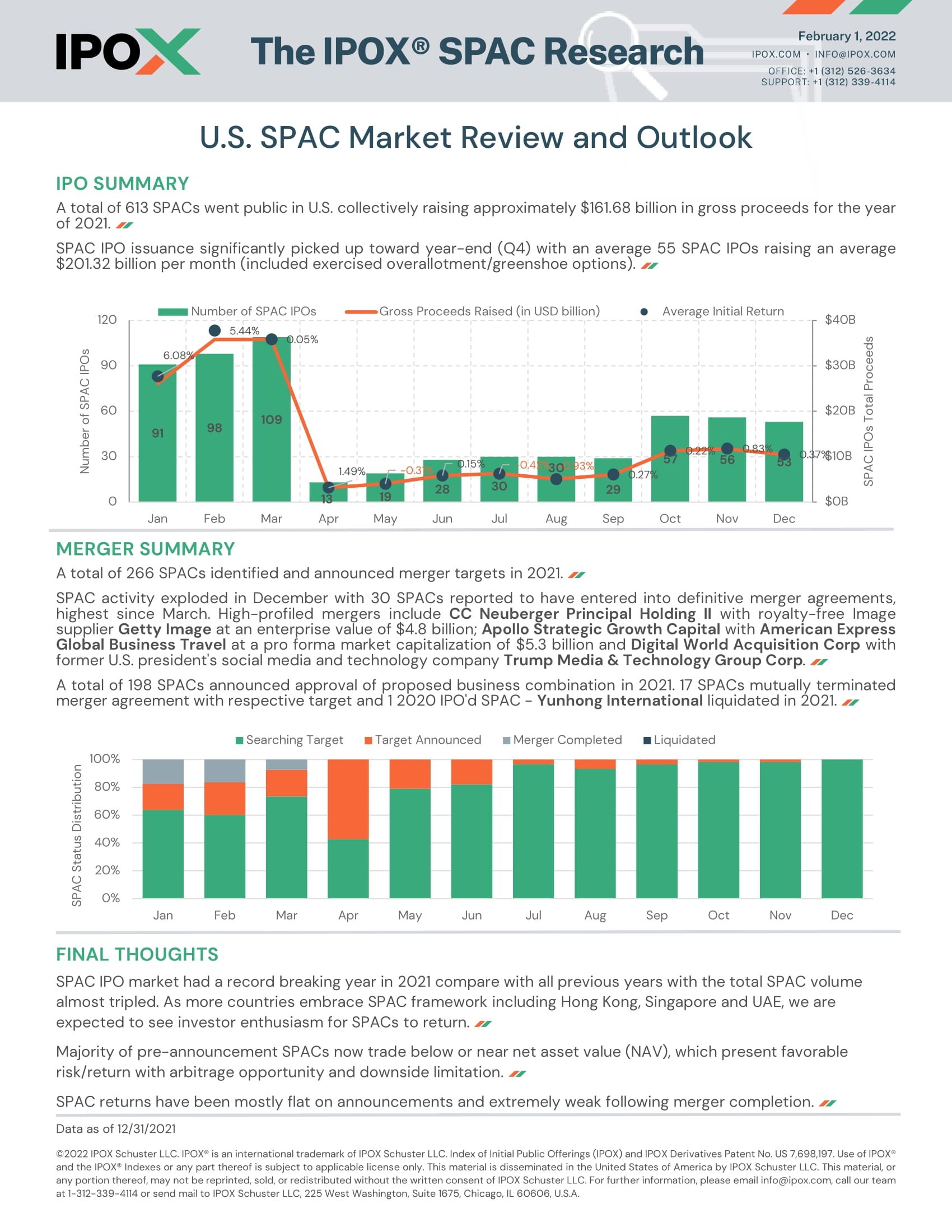

A total of 613 SPACs went public in U.S. collectively raising approximately $161.68 billion in gross proceeds for the year of 2021.

SPAC IPO issuance significantly picked up toward year-end (Q4) with an average 55 SPAC IPOs raising an average $201.32 billion per month (included exercised overallotment/greenshoe options).

A total of 266 SPACs identified and announced merger targets in 2021.

SPAC activity exploded in December with 30 SPACs reported to have entered into definitive merger agreements, highest since March. High-profiled mergers include CC Neuberger Principal Holding II with royalty-free Image supplier Getty Image at an enterprise value of $4.8 billion; Apollo Strategic Growth Capital with American Express Global Business Travel at a pro forma market capitalization of $5.3 billion and Digital World Acquisition Corp with former U.S. president's social media and technology company Trump Media & Technology Group Corp.