Astroscale Holdings Inc.

Astroscale Holdings Inc. (Ticker: 186A JP) is a Japanese space company that specializes in offering commercial services for the removal of space debris. Astroscale Holdings Inc. will list on June 5 on the Tokyo Stock Exchange’s Growth market. The company plans to sell between 23,593,300 and 26,718,200 shares at an indicative IPO price of 720 yen per share. The final IPO price is set to be determined on May 27. The estimated market capitalization at the time of listing is approximately 80.4 billion yen (USD equivalent not specified). The total offer size based on the indicative price will be calculated once the final share count and price are determined. The offering is managed by Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. Founder Mitsunobu Okada will offer 2.76 million shares in the IPO.

REZIL Inc

REZIL Inc (Ticker: 176A JP) is an electric distribution company based in Japan. The company specializes in providing solutions for the electric power supply chain, leveraging advanced digital technologies such as AI, IoT, and cloud computing to support a distributed energy ecosystem aimed at decarbonization.

REZIL Inc is set to list on the Tokyo Stock Exchange on April 24, 2024. The firm plans to offer 5.16 million shares, with a primary offering of 150,000 shares and a secondary offering of 5.01 million shares, priced between JPY 1,100 and JPY 1,200 per share. The total expected offer size is JPY 6.19 billion (approximately USD 40.77 million). Daiwa Securities Co Ltd is managing the offering. The IPO also includes a greenshoe option of 773,200 shares.

Material Group Inc

Material Group Inc (Ticker: 156A JP) is a Japan-based company operating in the advertising services sector. The firm specializes in providing comprehensive marketing communication support across various industries, focusing on enhancing the unique qualities of brands, products, services, and talents. Through its specialized expertise, PR-focused approach, and collaboration across its group entities, Material Group Inc aims to maximize potential and deliver tailored value to meet client-specific challenges.

The company is scheduled to list on the Tokyo Stock Exchange on March 29, 2024. Material Group Inc plans to raise JPY 5.77 billion (approximately USD 38.29 million) by offering 4.89 million shares at an expected price range of JPY 1,100 to 1,180 (USD 7.30 to 7.84). The IPO is managed by Nomura Securities Co Ltd.

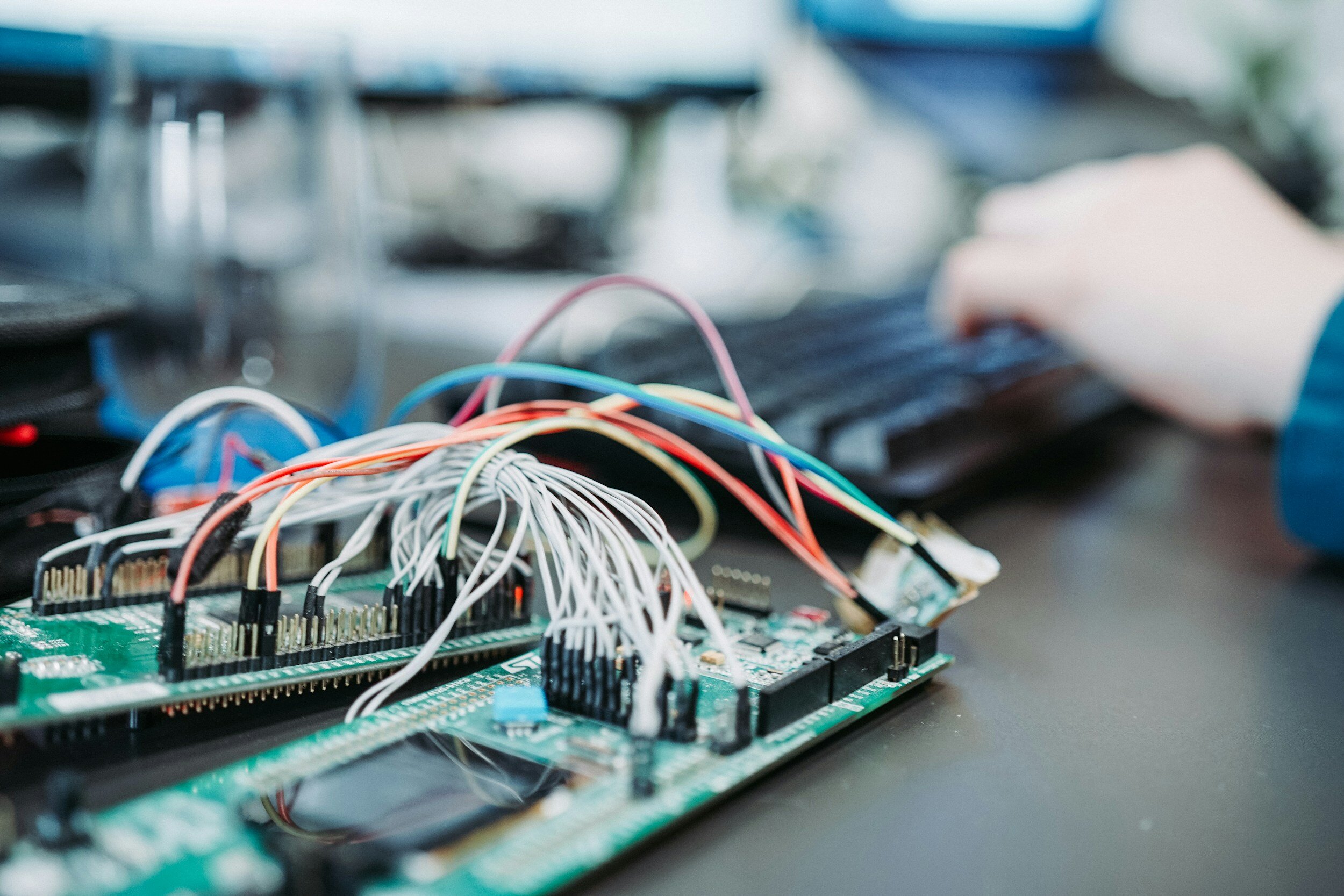

Soracom Inc

Soracom Inc (Ticker: 147A JP) is a telecommunications company based in Japan, specializing in the wireless equipment industry. The company is set to list on the Tokyo Stock Exchange on March 26, 2024. Soracom Inc aims to raise JPY 9.4 billion (approximately USD 62.71 million) through its Initial Public Offering (IPO). The offer price has been set at JPY 870.00 (USD 5.8038) per share, with a total of 10.81 million shares being offered. The IPO includes 4.73 million primary shares, accounting for 43.81% of the shares offered, and 6.07 million secondary shares, constituting 56.19% of the offering. Additionally, there is a greenshoe option of 1.62 million shares available. The offering is managed by Daiwa Securities Co Ltd and Mizuho Securities Co Ltd.

Soracom provides Internet of Things (IoT) solutions, enabling connectivity for a wide range of devices through services such as cellular connectivity for SIM card and eSIM devices, Wi-Fi, Ethernet, or satellite connections, and satellite messaging. The company also offers a suite of data and protocol management services. Soracom's mission is to equip technical innovators with the tools necessary to build a more connected world, showcasing a commitment to supporting various industries through its comprehensive IoT platform.

Trial Holdings Inc

Trial Holdings Inc (Ticker: 141A JP) is a retail company that operates discount stores in Japan, offering a wide range of products including fresh foods, ready-made meals, housewares, and appliances. Trial Holdings Inc will list on March 21, 2024 in Tokyo. The firm is selling 22.85 million shares at the price of JPY 1,700. The expected market capitalization at offer is JPY 202.11 billion (USD 1.34 billion). The total offer size is JPY 38.85 billion (USD 258.24 million). The offering is managed by Citigroup Global Markets Japan Inc, Citigroup Global Markets Ltd, Daiwa Capital Markets Europe Ltd, Daiwa Securities Co Ltd, and Mitsubishi UFJ Morgan Stanley Securities Co. Trial Holdings operates more than 280 stores and plans to use the IPO proceeds for new store openings, renovations, logistics centers, expansion of the central kitchen and processing centers, and other operations.

Human Technologies Inc.

Human Technologies Inc. (Ticker: 5621 JP) is a Japanese software company specializing in cloud-based time management systems, PC authentication enhancement systems, and fingerprint authentication development kits. The company has a significant user base across various sectors, with notable clients like Tokyo Gas, Timberland Japan, and Kobe Steel.

Human Technologies Inc. is set to list on the Tokyo Stock Exchange on December 22, 2023. The firm is offering 3.29 million shares at an offer price of JPY 1,224 per share, with an expected market capitalization of JPY 11.14 billion (USD 74.40 million). Around 2.3 million shares of the offers are being sold by individual private investors. The total offer size is JPY 4.02 billion (USD 26.88 million). Daiwa Securities Co Ltd and Mizuho Securities Co Ltd are managing the offering.

Japan Eyewear Holding Co Ltd

Japan Eyewear Holding Co Ltd (Ticker: 5889 JP), operating in the Optical Supplies industry, was established as a holding company in 2021, aims for global expansion with a focus on high-quality, fashionable eyewear and a robust sales network of directly managed stores and dealers.

Based in Japan, the company specializes in manufacturing and selling eyeglasses and optical products under its subsidiaries, primarily through the Kaneko Optical and Four Nines brands. The IPO will take place on the Tokyo Exchange, with Japan Eyewear Holdings expecting to raise JPY 8.99 billion. The offering is managed by Daiwa Securities Co Ltd and Mitsubishi UFJ Morgan Stanley Securities Co.

Japan Eyewear Holdings is selling 6.61 million shares at an offer price of JPY 1,360 per share. The expected market capitalization at the offer is JPY 32.56 billion (approximately USD 217.46 million), and the total offer size is JPY 8.99 billion (approximately USD 60.01 million). The IPO is scheduled for November 16, 2023. The offering includes 21.19% primary shares and 78.81% secondary shares, with a greenshoe facility of 15.00%.

Kokusai Electric Corp

6525 JP

Offer Price JPY 1.84k

Pre Shoe Amount JPY 108.28B

Shares Offered 58.85M

Kusurinomadoguchi Inc

5592 JP

Offer Price JPY 1.70k

Pre Shoe Amount JPY 4.76B

Shares Offered 2.80M

Seibu Giken Co Ltd

6223 JP

Offer Price JPY 2.60k

Pre Shoe Amount JPY 13.70B

Shares Offered 5.27M

Netstars Co Ltd

5590 JP

Offer Price JPY 1.45k

Pre Shoe Amount JPY 4.67B

Shares Offered 3.22M

AUTOSERVER Co Ltd

5589 JP

Offer Price JPY 2.67k

Pre Shoe Amount JPY 5.34B

Shares Offered 2.00M

Integral Corp

5842 JP

Offer Price JPY 2.40k

Pre Shoe Amount JPY 18.00B

Shares Offered 7.50M

Nareru Group Inc

9163 JP

Offer Price JPY 2.69k

Pre Shoe Amount JPY 9.37B

Shares Offered 3.48M

Rheos Capital Works Inc

7330 JP

Offer Price JPY 1.30k

Pre Shoe Amount JPY 4.18B

Shares Offered 3.22M

Rakuten Bank Ltd

5838 JP

Offer Price JPY 1.40k

Pre Shoe Amount JPY 83.31B

Shares Offered 59.51M

Ispace Inc/Japan

9348 JP

Offer Price JPY 254.00

Pre Shoe Amount JPY 6.74B

Shares Offered 26.52M

Transaction Media Networks Inc

5258 JP

Offer Price JPY 930.00

Pre Shoe Amount JPY 10.56B

Shares Offered 11.35M

SBI Sumishin Net Bank Ltd

7163 JP

Offer Price JPY 1.20k

Pre Shoe Amount JPY 49.76B

Shares Offered 41.47M

Monstarlab Holdings Inc

5255 JP

Offer Price JPY 720.00

Pre Shoe Amount JPY 3.74B

Shares Offered 5.19M

Halmek Holdings Co Ltd

7119 JP

Offer Price JPY 1.72k

Pre Shoe Amount JPY 4.21B

Shares Offered 2.45M

St Cousair Co Ltd

2937 JP

Offer Price JPY 1.80k

Pre Shoe Amount JPY 4.70B

Shares Offered 2.61M